Your Financial Plan

It took a lifetime to save for your retirement. Do you know how to turn it into a lifetime of income?

The Plan

When you work with a CFG CERTIFIED FINANCIAL PLANNER™ professional, you will obtain:

- A clear picture of your current financial status.

- A prioritized list of your most important financial goals.

- Investment strategies to help you reach your goals.

- Well-defined action steps to take, now and in the future.

The 6 Areas We Look At

A plan can provide a comprehensive analysis of your current financial situation. It may address the six areas of financial planning which include:

- Retirement Planning

Will you be able to retire when you want to? Will you have accumulated the money you’ll need? Will you run out of money too soon? Which should you draw down first—your regular accounts or your tax-deferred retirement accounts? This section provides projections to help answer these questions. - Investment Management

Are your investments allocated according to your risk tolerance, time horizon and specific needs? Is your portfolio properly diversified? Using the plan, your advisor can educate you and direct you toward strategies that fit your life goals. - Social Security Planning

Do you know your options for maximizing your social security benefit? Knowing when you or your spouse should claim may be one of the most important decisions you make during retirement. Your advisor can examine your options and provide you with recommendations. - Risk Management

Are you financially secure if the unexpected should happen? If you should die, would your dependents have the money to maintain their lifestyle, pay the mortgage or go to college? Insurance is a key component to any financial plan. - Tax and Estate Planning

This part of the plan analyzes the tax implications of financial decisions. Adjustments based on this analysis will assure the tax efficiency of your plan. It will also determine whether a living trust or sophisticated estate planning strategies should be utilized. Understanding whether your estate is subject to probate fees or estate taxes is crucial. - Cash Flow and Budgeting

What is your net worth? Where does your money go each month? This section of the plan gives you an interesting look at where and how you spend your money.

The Process

Now that you understand what a comprehensive financial plan will include, let’s walk through the process to get there. There will be a five point consultation process that includes:

- Discovery: The process begins with a comprehensive study of your current financial situation, your values and your goals.

- Education: A review of sound financial planning concepts such as diversification, asset allocation, investment strategies, tax planning and estate preservation.

- Planning: Based on the information provided, the personal plan becomes the blueprint to help you reach your financial goals.

- Implementation: Based on your personal plan, strategies to meet your current needs and future goals will be developed.

- Review: Once your program is under way, there will be a review of your financial priorities and goals to help keep your plan on track.

The Detail

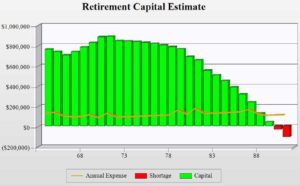

The financial plan will show your current financial picture. We use a cash flow planning platform to look at money coming in (income) and money going out (expenses). We then factor in existing assets, projected assets, taxes, and inflation. We project these assumptions over your lifetime to develop a workable plan. For example, the graph below shows a failing plan because of a shortfall in assets (red bars) in the later years. Our goal is “to get the red out!”

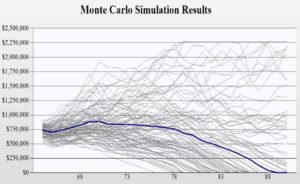

Once the red is out, we stress test the plan by running a probability analysis (example above right) to see how the plan performs when the variables are changed. The bottom line is the plan will give you a snapshot of whether your money will last over your lifetime and the probability of the plan working for you in your later years.

A plan and the process will give you a clear picture, perhaps for the first time, where you stand financially. Many families have no idea how much money they have in their estate, how they spend their money or what they want their money to do for them.

Why Work With a CFP® Professional?

By completing the financial planning process with one of our CERTIFIED FINANCIAL PLANNER™ professionals, you will be provided with direction and discipline. Without direction and discipline, impulsive, random decisions are often made. You will have the peace of mind knowing where you stand financially, where you’re going and what steps you need to take today to get there. Take the time, you and your family are worth it!

Start Today!

Come experience The Certified Difference!®. Arrange your no-obligation visit by calling us today at 407-869-9800 or request a visit.