If you have qualifying children under the age of 18, you may be able to claim a child tax credit. (You may also be able to claim a partial credit for certain other dependents who are not qualifying children.) The American Rescue Plan Act of 2021 makes substantial, temporary improvements to the child tax credit for 2021, which may increase the amount you might receive.

Ages of Qualifying Children

The legislation makes 17-year-olds eligible as qualifying children in 2021. Thus, children ages 17 and younger are eligible as qualifying children in 2021.

Increase in Credit Amount

For 2021, the child tax credit amount increases from $2,000 to $3,000 per qualifying child ($3,600 per qualifying child under age 6). The partial credit for other dependents who are not qualifying children remains at $500 per dependent.

Refundable Credit

The aggregate amount of nonrefundable credits allowed is limited to tax liability. With refundable credits, a taxpayer may receive a refund at tax time if they exceed tax liability. For most taxpayers, the child tax credit is fully refundable for 2021. To qualify for a full refund, the taxpayer (or either spouse for joint returns) must generally reside in the United States for more than one-half of the taxable year. Otherwise, under the pre-existing rules, a partial refund of up to $1,400 per qualifying child may be available. The credit for other dependents is not refundable.

Advance Payments

Taxpayers may receive periodic advance payments for up to one-half of the refundable child tax credit during 2021, generally based on 2020 tax returns. The U.S. Treasury will make the payments for periods between July 1 and December 31, 2021. For example, monthly payments could be up to $250 per qualifying child ($300 per qualifying child under age 6).

Phaseout of Credit

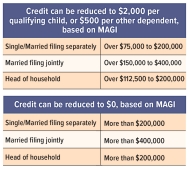

The combined child tax credit (the sum of your child tax credits and credits for other dependents) is subject to phaseout based on modified adjusted gross income (MAGI). Special rules start phasing out the increased portion of the child tax credit in 2021 at much lower thresholds than under pre-existing rules. The credit, as reduced under the special rules for 2021, is then subject to phaseout under the pre-existing phaseout rules.

For 2021, there no reduction in the credit if the taxpayer’s MAGI does not exceed $75,000 ($150,000 for joint returns and surviving spouses, $112,500 for heads of households). The credit is partially phased out for MAGI exceeding these income limits. At this stage, the credit is reduced by the lowest of the following three amounts:

- $50 for each $1,000 (or fraction thereof) of MAGI exceeding these thresholds

- The total increase in the credit amounts for 2021 [e.g., if 3 qualifying children (2 under the age of 6), then $10,200 increased credit minus $6,000 pre-existing credit = $4,200 increase in credit]

- $6,250 ($12,500 for joint returns, $4,375 for heads of households, $2,500 for surviving spouses); these amounts are equal to 5% of the difference between the higher pre-existing phaseout thresholds and the special thresholds for 2021

The credit cannot be reduced below $2,000 per qualifying child or $500 per other dependent at this stage under this special rule for 2021.

However, the credit can be fully phased out for MAGI in excess of $200,000 ($400,000 for a joint return) under the pre-existing phaseout rules. The credit as reduced in the preceding stage is further reduced by $50 for each $1,000 (or fraction thereof) by which the taxpayer’s MAGI exceeds these thresholds.