Have you been keeping tabs on the federal government lately? It seems they’re inching closer to that October 1 (Sunday) deadline, and if they don’t sort things out, we might be looking at a shutdown. Not the best economic news for the near future, we’d say. But we’re pretty sure the talking heads will be projecting doom and gloom as usual!

David Payne from Kiplinger put it this way: if the shutdown does happen, we’d see a 0.2% dip in the GDP growth for each week it lasts. Imagine that! Nonessential federal agencies would hit the brakes, and many federal employees wouldn’t get their paychecks. On the flip side, once everything’s back up and running, these workers would likely receive back pay. That could give us a little economic bump in early 2024.

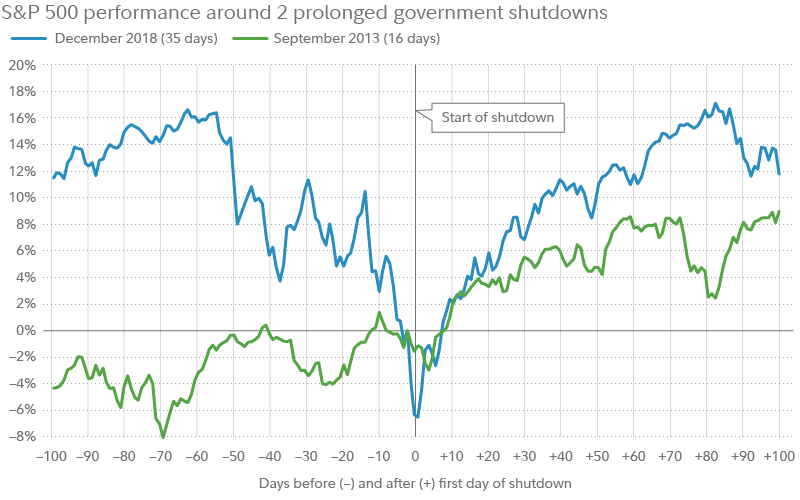

But you know what’s interesting? Historically, government shutdowns haven’t been all bad news for the stock market. Did you know that during the 21 government shutdowns since 1976, the S&P 500 actually went up 55% of the time? On average, it even gave a return of 0.3%! And, check this out: a year after these shutdowns, the S&P 500 increased 86% of the time, boasting an average return of 12.7%.

Remember the 35-day shutdown in 2018-2019? Seems like ages ago, right? But the S&P 500 managed a 10.3% return during that period. And let’s not forget how stocks held their ground during that lengthy shutdown back in October 2013.

While the past is no guarantee of the future, we thought you should know there’s another side to the story you’ll likely be hearing in the days to come.