If you or someone you know made a qualified charitable distribution (QCD) from your IRA in 2023, it’s important to report it when filing your taxes. However, it can be tricky to know how to do this, which is why we’re here to lay it out for you.

In 2023, individuals 70 1/2 and older could transfer up to $100,000 from a traditional IRA directly to charity. These can count as all or part of your required minimum distribution (RMD) but you’re not taxed on them, and they’re not added to your adjusted gross income.

That being said, when you receive your 1099-R Form this year, it will not reflect the QCD, but rather only show the total distributions taken in 2023. So, how do you make sure your distributions and QCD are reported correctly? Let’s go through the steps.

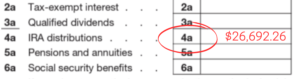

Step 1: Locate your gross distribution on your 1099-R Form.

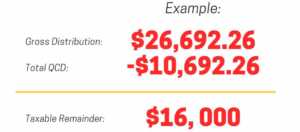

Step 2: Subtract the total amount of QCD from the gross distribution amount. For this example, let’s say your QCD for 2023 totaled $10,692.26.

Step 3: Locate your 1040 Form. On Line 4a, insert the total amount of distributions previously found on your 1099-R Form.

Step 4: On Line 4b of your 1040 Form, report the taxable remainder found earlier in your calculations (even if this amount is $0).

Step 5: Write “QCD” next to Line 4b so the IRS knows why the numbers don’t match. If using a tax filing software, a drop-down box for Line 4b should give you the choice to select QCD.

That will do it! If you have any further questions, please consult a tax professional or use the resources available on the IRS’s website linked here. Happy tax filing!

Sources

The Kiplinger Tax Letter , Vol. 99, No. 4, Kiplinger Washington Agency

Disclaimer: The information contained in this presentation is not written or intended as financial, tax, legal or accounting advice. This material has been prepared for educational purposes only as of the date of writing, by sources believed reliable, and may change at any time based on economic, market, policy, or other conditions and may not come to pass.