The first part of 2020 was rocky, but there should be better days ahead. Taking a close look at your finances may give

you the foundation you need to begin moving forward. Mid-year is an ideal time to do so, because the planning opportunities are potentially greater than if you waited until the end of the year.

Renew Your Resolutions

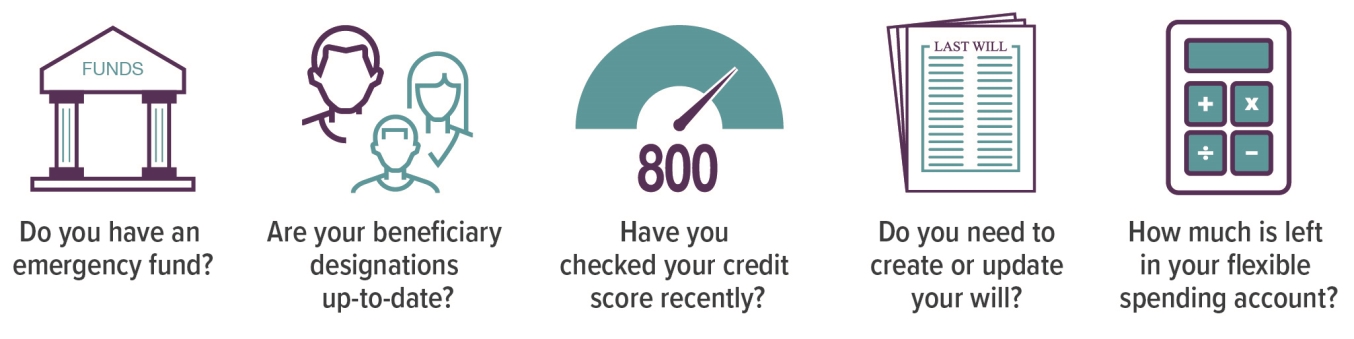

At the beginning of the year, you may have vowed to change your financial situation, perhaps by saving more, spending less, or reducing your debt. Are these resolutions still important to you? If your income, expenses, and life circumstances have changed since then, you may need to rethink your priorities.

While it may be difficult to look at your finances during turbulent times, review financial statements and account balances to determine whether you need to make any changes to keep your financial plan on track.

Take Another Look at Your Taxes

Completing a mid-year estimate of your tax liability may reveal planning opportunities. You can use last year’s tax return as a basis, then factor in any anticipated adjustments to your income and deductions for this year.

Check your withholding, especially if you owed taxes or received a large refund. Doing that now, rather than waiting until the end of the year, may help you avoid a big tax bill or having too much of your money tied up with Uncle Sam.

You can check your withholding by using the IRS Tax Withholding Estimator at irs.gov. If necessary, adjust the amount of federal or state income tax withheld from your paycheck by filing a new Form W-4 with your employer.

Review Your Investments

Review your portfolio to make sure your asset allocation is still in line with your financial goals, time horizon, and tolerance for risk. Look at how your investments have performed against appropriate benchmarks, and in relationship to your expectations and needs. Changes may be warranted, but be careful about making them while the market is volatile.

Asset allocation is a method used to help manage investment risk; it does not guarantee a profit or protect against investment loss. All investing involves risk, including the possible loss of principal and there is no guarantee that any investment strategy will be successful.

Check Your Retirement Savings

If you’re still saving for retirement, look for ways to increase retirement plan contributions. For example, if you receive a pay increase this year, you could contribute a higher percentage of your salary to your employer-sponsored retirement plan, such as a 401(k), 403(b), or 457(b) plan. If you’re age 50 or older, consider making catch-up contributions to your employer plan. For 2020, the contribution limit is $19,500, or $26,000 if you’re eligible to make catch-up contributions. If you are close to retirement or already retired, take another look at your retirement income needs and whether your current investment and distribution strategy will provide enough income.

Read About Your Insurance Coverage

What are the terms of your homeowners, renters, and auto insurance policies? How much disability or life insurance coverage do you have? Your insurance needs can change; make sure your coverage has kept pace with your income or family circumstances.