For a full breakdown of 2024’s tax brackets and more changes to things like contribution limits, health savings accounts (HSA), Medicare premiums, and more, check out the link here: 2024 Annual Limits.

The IRS has announced the official tax brackets for 2024. To adjust for inflation, they have widened all of the brackets, meaning you may have more money in your pocket next year. Here’s a breakdown of what the IRS did:

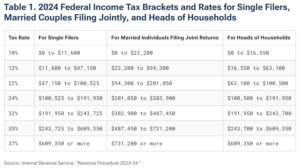

- Tax Rates Remain the Same: There are still seven different tax rates – 10%, 12%, 22%, 24%, 32%, 35%, and 37%. These rates haven’t changed from 2023.

- Who Pays What HAS Changed (see graph below):

- Higher Standard Deduction: The standard deduction, which is a set amount of income that you don’t have to pay tax on, has gone up. For married couples filing together, it’s now $29,200. This increase means you could pay less in taxes if you don’t use itemized deductions.

- Why These Changes Matter: Because of these updates, you might end up in a lower tax bracket than before, especially if your income hasn’t increased significantly. This could mean you’ll owe less in taxes. The higher standard deduction also helps because it increases the amount of your income that isn’t taxed.

In summary, these changes aim to ensure that people don’t pay more taxes just because prices have gone up. It’s all about adjusting to the cost of living, so your taxes are more in line with what you can afford.

Sources